Achieve your financial goals with Lendvia. Learn more!

At Lendvia, our advanced model considers factors beyond your credit history.

Choose an amount for a personal loan between $1,000 and $50,000.

Select from our 3-5-year options, with fixed rates ranging from 5.99% to 35.99% APR⁵.

Home improvements can transform your living space, increase property value, and make everyday life more comfortable but renovations often come with a high price tag. From remodeling your kitchen to adding a new bathroom or upgrading interiors, costs can add up quickly. That’s where home improvement loans step in. A house improvement loan provides the financial flexibility you need to spread expenses into easy monthly payments while enjoying your upgraded space today. Whether you’re looking for the best home improvement loans or need a low-interest home improvement loan, Lendvia helps you finance your vision without draining your savings.

Our home improvement financing solutions are designed to meet a wide range of needs, whether it’s a complete home renovation, fixing up essential repairs, or making small upgrades. With competitive home improvement loan rates, flexible repayment terms, and fast approvals, Lendvia makes financing stress-free. No matter the size of your project, from large remodels to minor upgrades, you’ll find a loan option that suits your budget. Choosing the best home loan company ensures you can focus on your home transformation without financial pressure.

One of the biggest benefits of a home improvement loan is that it allows you to renovate without needing collateral, especially with unsecured options. Even if you face credit challenges, we offer flexible financing to help you move forward with your plans. Instead of maxing out credit cards or putting projects on hold, a low-interest home improvement loan makes upgrades affordable with predictable monthly payments. With Lendvia, you can tackle repairs or renovations confidently knowing you’re supported by a trusted lender.

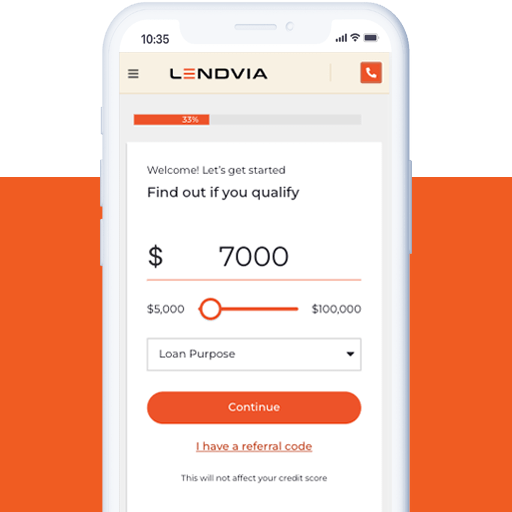

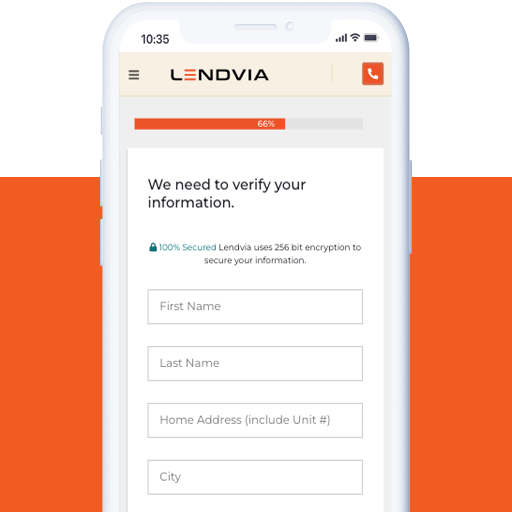

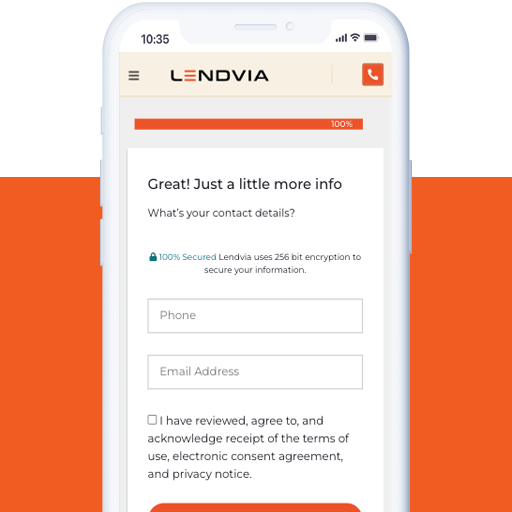

To get started, fill out the form with your basic information. Let us know the best time for us to contact you. We respect your time and will make sure our loan specialists are available when it’s most convenient for you.

Home improvement loans typically involve a straightforward process. First, you check your options and get your rate by providing necessary details about the loan amount, purpose, personal information, and financials.

Once you receive options you qualify for, you can select the amount, term, and rate that suit your needs. After submitting a loan application with additional information and completing the necessary validations, your loan will be approved and funded, often as fast as 1 business day².

Yes, you can. Unlike home equity loans that require you to have equity in your home, Lendvia offers unsecured home improvement loans.

This means you can get the funds you need for your renovation projects without having to put up collateral.

A home improvement loan is a great choice if you need financial assistance for home repairs or projects and prefer a fixed-interest, predictable monthly payment plan.

If you’d like to consider other options like a Home Equity Line of Credit (HELOC), Lendvia can provide guidance and assistance in exploring different financing options.

By choosing Lendvia for your home improvement loan, you’ll benefit from a quick and simple online application process, fixed interest rates that offer stability, predictable monthly payments that fit your budget, and direct deposit for fast access to funds.

Additionally, Lendvia considers factors beyond just your credit score, such as education⁹ and employment, to provide you with better rates that reflect your true financial situation.

Ready to transform your home? Check your home improvement loan rate in as little as 5 minutes and take the first step towards making your dream home a reality.