Achieve your financial goals with Lendvia. Learn more!

Experience the freedom and flexibility of Lendvia’s personal loans, designed to empower you on your financial journey.

Get a wedding loan that’s tailored to your unique circumstances.

Choose between 3-5-year loan options, featuring fixed rates from 5.99% to 34.99% APR.

Pay off your loan ahead of schedule without any additional charges or penalties.

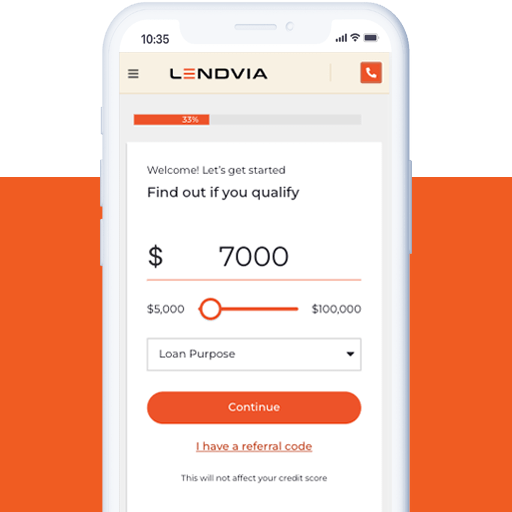

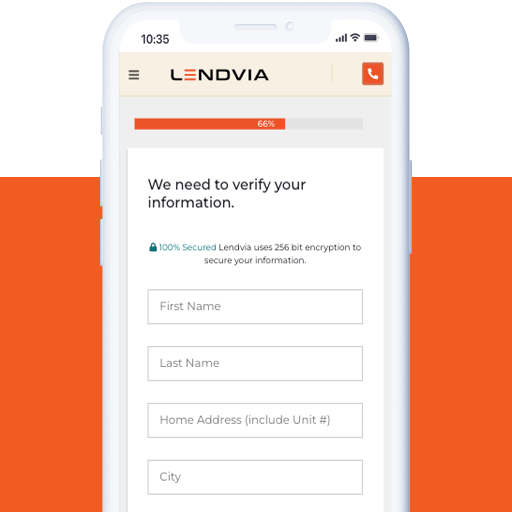

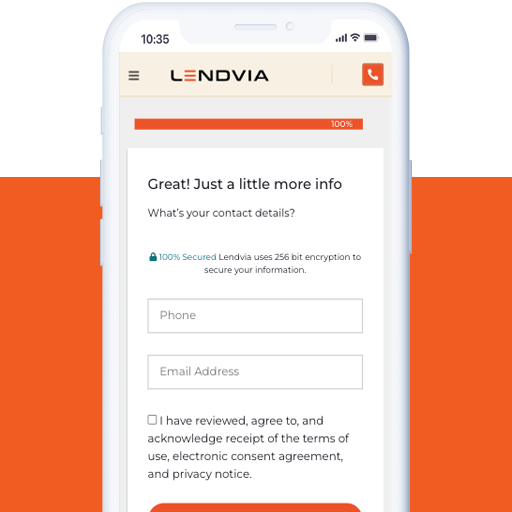

To get started, fill out the form with your basic information. Let us know the best time for us to contact you. We respect your time and will make sure our loan specialists are available when it’s most convenient for you.

Brace yourself for the magic of Lendvia! Our application process is as smooth as silk, and you’ll get a decision faster than you can say “I do.” If approved, you’ll receive a lump sum of cash to cover all your wedding must-haves: engagement rings, swoon-worthy attire, venue deposits, travel and lodging expenses, and even those honeymoon vibes.

From there, it’s all about making those monthly payments until you’ve triumphantly paid off the balance or reached your agreed-upon payoff date.

Don’t sweat it! When you check your rates with us, we’ll conduct a soft credit inquiry. No need to worry about it affecting your credit score.

But heads up, if you decide to move forward and submit an application, a hard credit inquiry will be done. It might have a small impact, but hey, timely monthly payments can actually boost your credit score over time.

It’s a piece of cake! In less than 5 minutes, you can check your rate for a personalized wedding loan. Fill out our online funding form with all the deets, including your desired loan amount, contact info, education⁴, income, and total savings and investments.

Once you’ve got your initial offers, it’s time to pick the one that suits you best. We’ll guide you through the verification process and the funding, making sure you can focus on planning the perfect day.

Lendvia offers wedding loan amounts between $1,000 and $50,000, depending on your qualifications and the information provided in your application. The exact loan amount you can borrow will be determined during the application process.

Lendvia takes a holistic approach to evaluating loan applications. While credit history is considered, we also take into account other factors such as education and employment.

We believe in giving everyone a fair chance, so don’t hesitate to apply even if you have less-than-perfect credit.

Lendvia’s wedding loans have an origination fee, which covers the costs of processing and servicing the loan.

The fee is deducted from the loan amount at the beginning, and all terms and fees will be disclosed to you before accepting the loan.

Absolutely! At LendVia, we encourage responsible financial management. You have the flexibility to prepay your wedding loan at any time without any penalties or fees.

Making additional payments can help you pay off the loan faster and potentially save on interest costs.