Achieve your financial goals with Lendvia. Learn more!

Experience the freedom and flexibility of Lendvia’s personal loans, designed to empower you on your financial journey.

Lendvia looks beyond credit scores, considering education⁴, employment, and more for personalized rates.

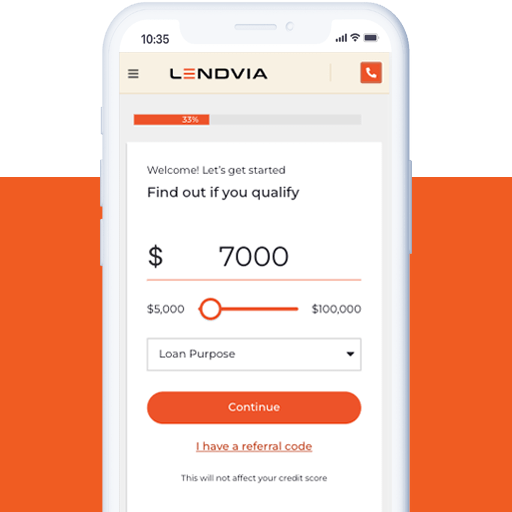

Lendvia offers flexible loan amounts from $1,000 to $50,000⁵ for any financial need.

Manage your finances on your terms and pay off your loan early without extra costs or penalties.

Personal loans are one of the most flexible financing options available, helping you cover everything from medical expenses and education costs to travel, home renovations, or debt consolidation. With Lendvia, you can access the best personal loans from trusted lenders with competitive terms and fast approvals. Whether you need funds urgently or want to plan ahead with manageable monthly payments, our network of the best personal loan lenders ensures you get financing that suits your lifestyle and budget.

Choosing the right lender means understanding your options. At Lendvia, we make it simple to compare personal loan rates so you know exactly what you’re paying before committing. We connect you to lenders offering low-interest personal loans, giving you the financial freedom to borrow without the stress of high repayments. With transparent terms and competitive personal loan interest rates, you can borrow with confidence and peace of mind.

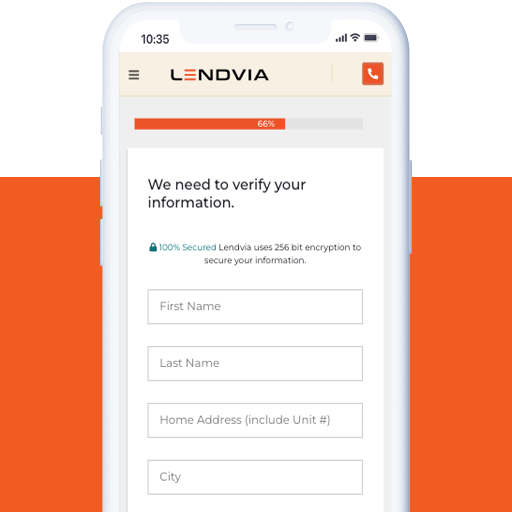

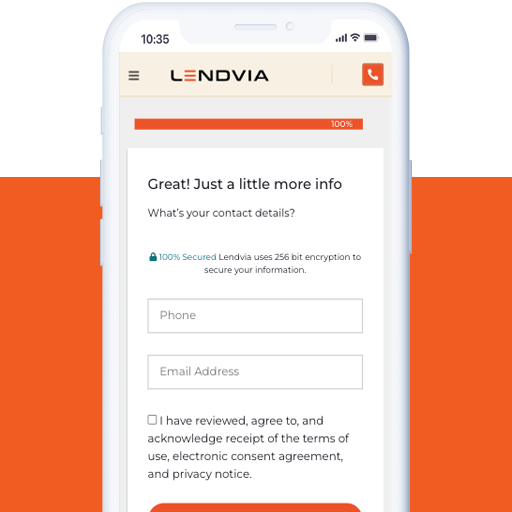

To get started, fill out the form with your basic information. Let us know the best time for us to contact you. We respect your time and will make sure our loan specialists are available when it’s most convenient for you.