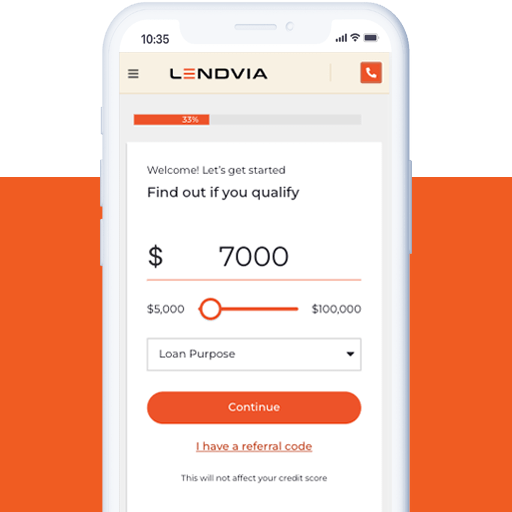

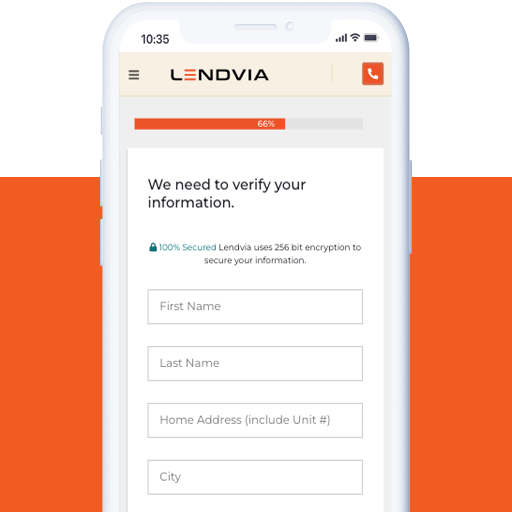

Are you searching for a flexible and convenient solution to address your financial needs? Look no further than Lendvia and our range of personalized personal loans. Whether you need to consolidate debt, cover unexpected expenses, or fund significant purchases, Lendvia is here to help.

We provide competitive interest rates, flexible loan amounts, and a variety of repayment options tailored to your unique circumstances and goals. Our dedicated team is committed to guiding you every step of the way, making sure you have the information and assistance you need to make informed decisions about your financial journey.

Don’t let financial limitations hold you back. Experience the freedom and flexibility of Lendvia’s personal loans, designed to empower you on your financial journey.

Explore the top 10 ways to use personal loans and discover how Lendvia can help you achieve your financial goals with ease. Together, let’s embark on a path towards financial empowerment.

Embrace Life's Unexpected Expenses

- 1. Medical Bills and Healthcare Costs: When medical emergencies strike, a personal loan can be a financial lifeline. Whether it's unexpected medical bills or elective procedures not covered by insurance, a personal loan can provide the necessary funds to alleviate the stress of healthcare costs. Focus on your well-being without compromising your financial stability.

- 2. Home Repairs and Renovations: Your home is your sanctuary, but it requires maintenance. When unexpected repairs or renovations arise, a personal loan can provide the funds needed to keep your home in top shape. From fixing a leaky roof to upgrading your kitchen, a personal loan allows you to invest in your home's value and comfort.

Realize Your Dreams and Aspirations

- 3. Wedding Expenses: Your special day deserves to be everything you've imagined. A personal loan can help make that dream wedding a reality. Whether it's covering venue costs, catering, or the perfect dress, a personal loan allows you to create cherished memories without compromising your budget.

- 4. Travel and Vacation: Pack your bags and explore the world with a personal loan. Whether you're dreaming of an exotic adventure or a relaxing beach getaway, a personal loan can fund your travel dreams. Create unforgettable memories and experience new cultures while spreading out the cost with affordable monthly payments.

Invest in Your Financial Future

- 5. Higher Education: Investing in education pays dividends for a lifetime. If you're pursuing a degree or furthering your education, a personal loan can bridge the financial gap. From tuition fees to textbooks, a personal loan helps you invest in your future and unlock doors to new opportunities.

- 6. Career Development: Enhancing your professional skills and advancing your career often comes with a cost. Whether it's attending workshops, obtaining certifications, or pursuing additional training, a personal loan can provide the necessary funds to invest in your career growth and increase your earning potential.

Seize Opportunities and Make Major Purchases

- 7. Vehicle Financing: Reliable transportation is essential for most people. When it's time to upgrade your vehicle or purchase your first car, a personal loan can help you hit the road. From financing a new or used car to covering maintenance and repairs, a personal loan ensures you have the wheels you need to go places.

- 8. Business Ventures and Start-ups: Entrepreneurial spirit burning bright? A personal loan can be a stepping stone to launch your business or fund your start-up. From securing inventory to marketing expenses, a personal loan provides the capital infusion you need to turn your entrepreneurial dreams into a reality.

Consolidate and Conquer Your Debt

- 9. Debt Consolidation: Personal loans can be a powerful tool to tackle multiple high-interest debts. By consolidating your debts into a single loan with a lower interest rate, you can save money on monthly payments and simplify your financial obligations. Say goodbye to juggling multiple payments and hello to a clearer path to becoming debt-free.

- 10. Credit Card Payoff: If credit card balances are weighing you down, a personal loan can help you regain control. Use the funds to pay off those high-interest credit card debts and consolidate them into one manageable loan. Enjoy lower interest rates and a structured repayment plan that sets you on the fast track to financial freedom.

Takeaways

Take advantage of the top 10 ways to use personal loans and unlock the doors to financial freedom. Consolidate your debts, conquer your financial burdens, and pave the way to a debt-free future.

Embrace life’s unexpected expenses without worry, knowing you have the funds to cover medical bills and home repairs. Realize your dreams and aspirations, from the perfect wedding to unforgettable travel experiences.

Invest in your future through higher education and career development, opening doors to success. Seize opportunities and make major purchases, whether it’s a reliable vehicle or launching your own business.

At Lendvia, we are committed to providing personalized financial solutions that empower you to achieve your goals. Our team is here to guide you every step of the way, ensuring you make informed decisions and embark on a journey towards financial empowerment.

Choose Lendvia for your personal loan needs, and experience the freedom and flexibility that come with our tailored solutions. Together, we’ll make your financial aspirations a reality.