At Lendvia, we understand that personal loans can be an important financial tool to help you achieve your goals. Our resource center is dedicated to providing you with valuable information and resources about personal loans.

When it comes to addressing various financial needs and achieving your goals, personal loans offer a flexible and convenient solution.

Whether you’re looking to consolidate debt, cover unexpected expenses, or make a significant purchase, personal loans provide the funds you need without requiring collateral.

Understanding Personal Loans

Personal loans are unsecured loans that allow individuals to borrow a fixed amount of money for various purposes. Unlike specific-purpose loans like mortgage or auto loans, personal loans provide flexibility in their use.

Personal loans typically have fixed interest rates, which means the monthly payment remains the same throughout the loan term. These loans are repaid in installments over a set period, ranging from a few months to several years, depending on the loan terms and the borrower’s preferences.

One of the significant benefits of personal loans is their versatility. You can use the funds for a wide range of purposes, such as debt consolidation, home improvements, medical expenses, or even a dream vacation.

Additionally, personal loans often have more favorable interest rates compared to credit cards, making them a popular choice for those seeking to manage their finances efficiently.

Types of Personal Loans

- Personal loans can be categorized into two main types: fixed-rate loans and variable-rate loans.

- Fixed-rate loans maintain a consistent interest rate throughout the loan term, providing stability and predictability.

- On the other hand, variable-rate loans feature interest rates that can fluctuate over time, which may be advantageous for certain borrowers.

Benefits of Personal Loans

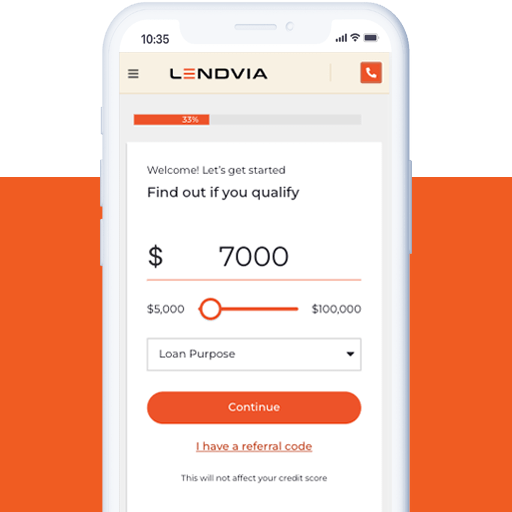

Our personal loans are designed to provide you with a world of possibilities. Whether you’re looking to consolidate high-interest debt, fund a major purchase, or embark on a dream vacation, our personal loan benefits include competitive rates, convenient repayment terms, and a seamless application process. Here are some of the benefits of acquiring personal loans:

- Flexibility: Personal loans grant you the freedom to utilize the funds for various purposes. Whether you're consolidating debt, handling unexpected expenses, or making a significant purchase, a personal loan can adapt to your needs.

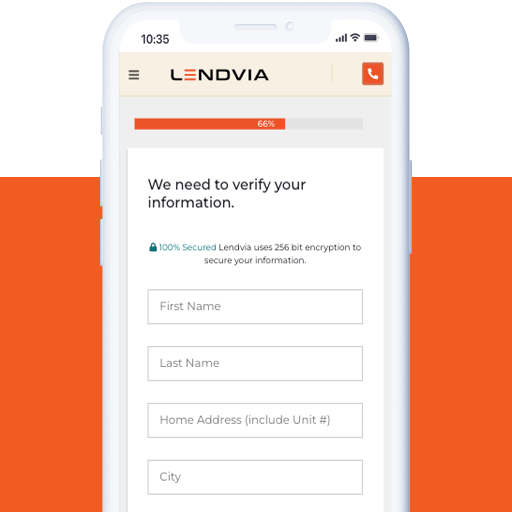

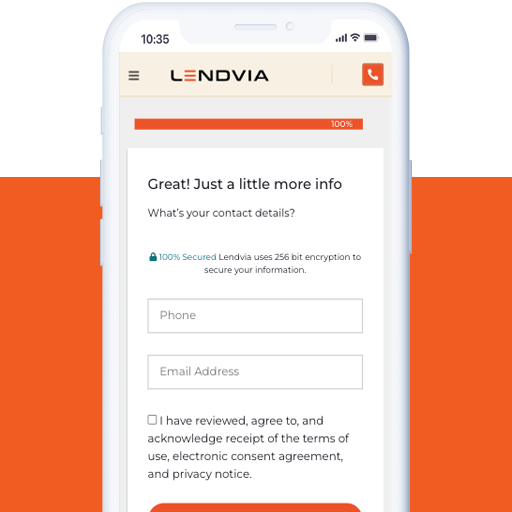

- Convenience: At Lendvia, we understand the value of time. Our personal loan application process is quick and straightforward, ensuring you receive the funds promptly when you need them most.

- Competitive Interest Rates: Our personal loans come with competitive interest rates, allowing you to save on monthly payments while effectively managing your finances.

Potential Uses for Personal Loans

Personal loans can be used in every need or maybe wants. It solely depends on the person. But here in Lendvia here are the most used loans with our customers:

- Handling Unexpected Expenses: Life is full of surprises, and unexpected expenses can arise at any time. Whether it's a sudden car repair or an unforeseen medical bill, a personal loan can provide the necessary funds to cover these expenses and alleviate financial stress.

- Making Significant Purchases: From dream homes to reliable vehicles, personal loans can empower you to make substantial purchases. If you're planning a major investment, such as buying a new home or car, a personal loan can offer the financial support you need to turn your aspirations into reality.

- Debt Consolidation: If you find yourself burdened with multiple high-interest debts, a personal loan can streamline your financial situation. By consolidating your debts into a single loan with a lower interest rate, you can save money on monthly payments and accelerate your journey to becoming debt-free.

Why Choose Lendvia for Your Personal Loan?

- 1. Your Full Financial Picture: At Lendvia, we go beyond credit scores and consider various factors such as education, employment, and more to provide personalized rates tailored to your unique circumstances.

- 2. Flexible Loan Amounts: We offer a wide range of loan amounts, starting from $1,000 and going up to $50,000, allowing you to borrow precisely what you need to address your financial requirements.

- 3. Fixed Rates and Terms: Choose from our 3-year or 5-year options, with rates ranging from 4.6% to 35.99% APR. With fixed rates, you can enjoy stability and predictability throughout the loan term.

- 4. No Prepayment Fees: Take control of your finances and pay off your loan early without any extra costs or penalties. Lendvia believes in empowering you to manage your loan on your terms.