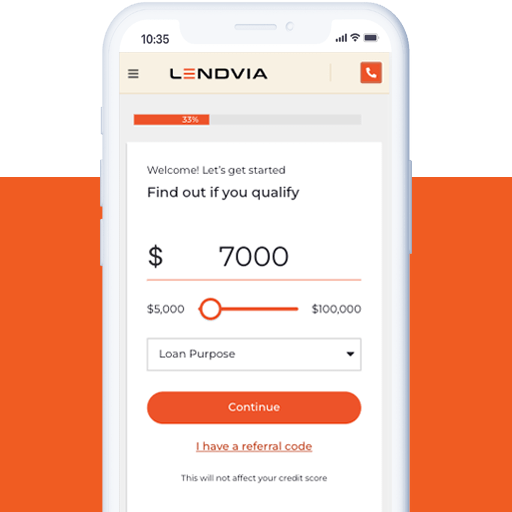

Achieve your financial goals with Lendvia. Learn more!

We go beyond your credit score, our model considers factors such as education and employment.

Our APR ranges from 5.99% to 34.99% for loan amounts from $5,000 to $100,000.

We offer the flexibility to prepay your moving loan at any time, with no fees or penalties.

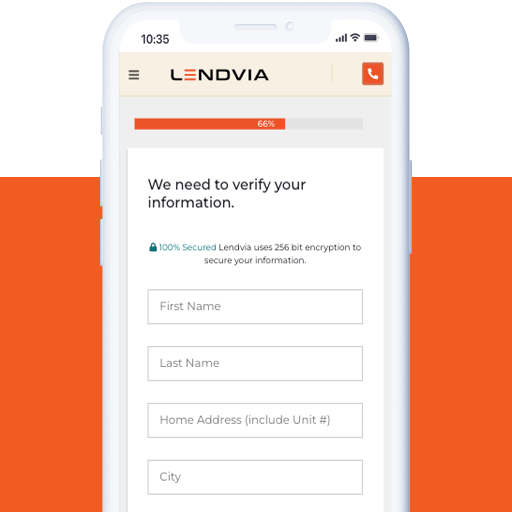

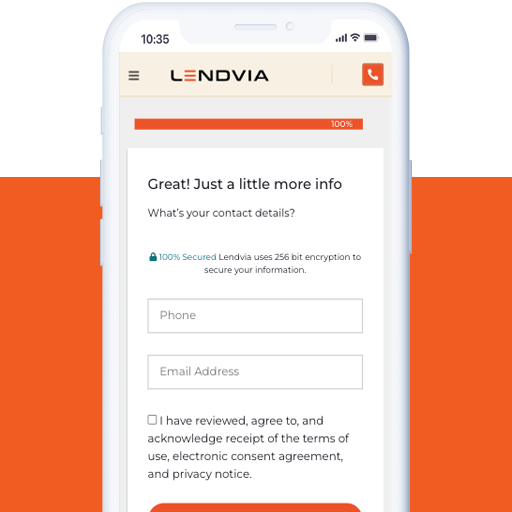

To get started, fill out the form with your basic information. Let us know the best time for us to contact you. We respect your time and will make sure our loan specialists are available when it’s most convenient for you.

At LendVia, we take a comprehensive approach to evaluating loan applications. While credit history is considered, we also take into account factors such as education and employment.

We believe in giving everyone a fair chance, so don’t hesitate to apply even if you have less-than-perfect credit.